Peak Platform

Your toolkit for fast lane any fintech innovation.

A fully integrated ecosystem designed to accelerate the fintech product development cycle. Native mobile banking app that forms the perfect foundation for crafting specialized banking solutions, aligning seamlessly with your brand's objectives.

Capabilities

Build your fintech product block by block. Designed for flexibility, built for scale: choose and combine modules from our platform.

Every capability is backed by developer-friendly APIs and SDKs, designed for seamless integration and customization.

Account

Card

Money transfers

KYC

PSP gateway

Hierarchical Relations

CMS

Open Banking Gateway

Monitoring

Account

Effortless fund transfers and straightforward account opening with our all-in-one bank account solution.

Card

Spend confidently: Our Visa and Mastercard offerings provide both virtual and physical cards, ensuring convenience is always within reach.

Money transfers

End-to-end solutions tailored for swift, secure global transactions — get your money where it needs to go with confidence.

KYC

Know your customer. Experience the future of identification with our 2-minute KYC process, enhanced by AI-driven capabilities.

PSP gateway

Specifically design for the integration with any core-banking systems in any locations via API. Engineered to support any payment service provider, it ensures maximum flexibility for your financial transactions. No matter the PSP, our gateway integrates seamlessly, granting your users a consistent and secure financial experience.

Hierarchical Relations

Pre-defined database relations for specific products, such as parent-child relation in family banking, or owner-manager hierarchies in every layer of interaction. Simplify complexities, and enhance user understanding.

CMS

Purpose-built content management system for the fintech industry, it provides a robust platform to craft, update, and streamline your digital contents, ensuring your audience always has the latest information.

Open Banking Gateway

Seamlessly integrate with banks and streamline data flow, all within a secure and compliant framework. Empower your product with our Account Information Service Provider (AISP) capabilities, allowing integration with your customers' bank accounts for real-time balance and transaction monitoring.

Monitoring

Our platform features event source monitoring, allowing your admins to track any activities in real-time for enhanced security and customer experience. Combined with customizable dashboards, you can have a panoramic view of all operations at a glance, ensuring everything runs seamlessly under your watch.

Marketplace

Unlock more.

Our plug n’ play marketplace enables you to add third-party integrations and additional features.

DiPocket

GoCardless Bank Account Data

NAV

Know Your Customer (KYC)

New integrations

DiPocket

UK and Lithuania based financial institution with the ability to issue prepaid, debit and credit cards in the EEA, and in the UK. Integrated processor (Thredd) and card manufacturer (TAG Systems). Quick go-live issuing possibility with Visa and Mastercard cards.

GoCardless Bank Account Data

First in class Account Information Service Provider (AISP) integration covering more than 2000 banks in Europe and UK.

NAV

Nemzeti Adó- és Vámhivatal. Access invoices and other financial data right from the Hungarian government IT system.

Know Your Customer (KYC)

AI-based know your customer solution for B2C and B2B identification. Mobile (iOS, Android), web based client applications with SDK approach. Admin panel (SDK available) or API based customer support interface. Automatized assessment and scoring with AI.Liveness check, face recognition, NFC ID reading.

New integrations

Continuously evolving, our marketplace showcases a wide array of integrations and third-party tools, featuring already: Mastercard Connect, Mastercard Send, Visa Direct, Sendgrid, Stripe, Zapier.

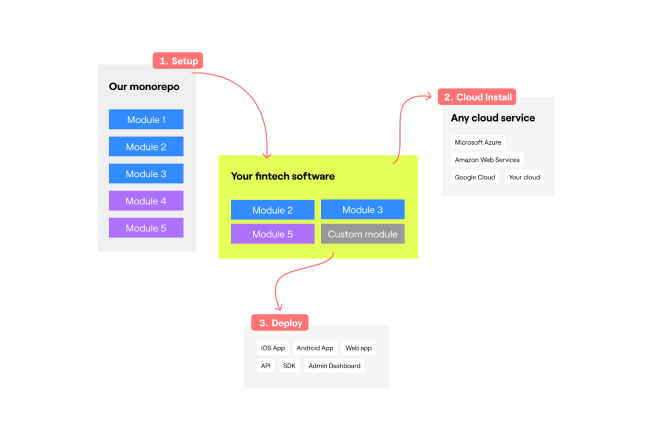

Cloud infrastructure

Your product is deployed to the cloud of your choice - be it Microsoft Azure, Amazon, Google Cloud, or any custom solution you prefer. The result? Swiftly delivered, bespoke mobile and web applications.

Technology

Experience unmatched flexibility with Peak Platform. Whether you opt for our end-to-end mobile apps or prefer to integrate using our robust APIs, we cater to your unique needs seamlessly. Crafted with an SDK-first approach, our solutions are modular by design, ensuring easy integration with your existing systems. For instance, enhance your current mobile app by embedding a widget, like a balance display.

How does it work?

At the heart of Peak lies our expansive monorepo, brimming with specialized modules, all securely housed in our cloud environment. When you're in need of a fintech solution, we craft a tailored configuration, pulling from our library of modules to match your brand, language preferences, and unique features.

Why Peak platform?

Because in the fast-evolving world of fintech, you need a platform that's agile, robust, and always ahead of the curve. With our wide array of integrations, user-centric design, and unwavering reliability, Peak Platform is not just a choice—it's the best choice.